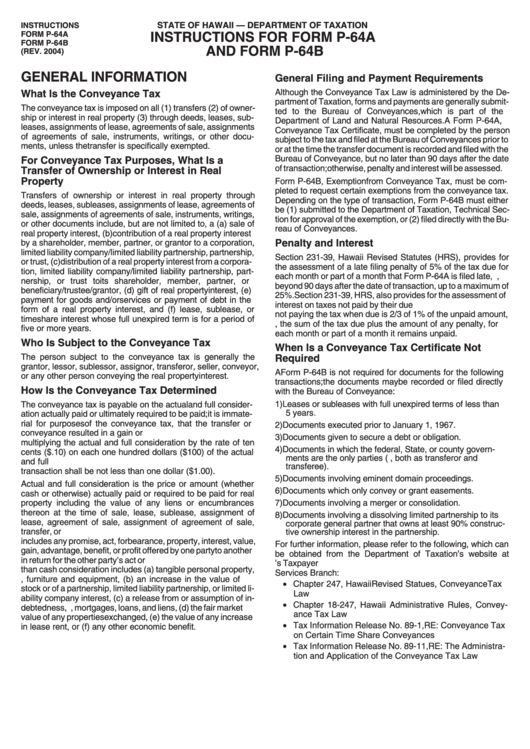

In addition, any of the 18 targeted investment communities or any municipality in which properties designated as qualified manufacturing plants are located has the option to impose an additional tax at a rate of up to 0.25% of the consideration for the interest in real property conveyed by the deed, instrument, or writing. The municipal portion of the conveyance tax is 0.25% of the consideration for the interest in real property conveyed by deed, instrument or writing that is at least $2,000. The 1.25% rate applies to nonresidential property other than unimproved land and to the amount of a residential property in excess of $800,000. The 0.75% rate applies to unimproved land, to the first $800,000 of residential property, and to conveyance of real property with mortgage payments delinquent in excess of 6 months to the financial institution holding the delinquent mortgage. The state portion of the conveyance tax is either 0.75% or 1.25% of the consideration for the interest in real property conveyed by deed, instrument, or writing that is at least $2,000.

The state imposes a real estate conveyance tax, one part payable to the state and the other part payable to the municipality in which it is paid, and allows any targeted investment community or any municipality of less than 20,000 population with a qualified manufacturing plant the option to impose an additional tax.

0 kommentar(er)

0 kommentar(er)